A global leader

in impact investing

Our mission as an impact investor is to find, support and scale the most disruptive, impactful solutions to accelerate progress towards global sustainability targets.

Impact investing is the key catalyst that can finance and scale the systemic disruption needed to reach the ambitious targets set forth by the Paris Agreement, the UN SDGs and the European Commission’s Farm to Fork strategy.

By investing in promising, technology-driven, impact-focused companies we experience no trade-off between return and impact. The more successful the business, the more impact there will be.

Astanor’s previous Impact Creation Reports:

Our Approach

We have defined six impact KPIs to capture a holistic image of our positive impact. This includes three planet KPIs for addressing climate change challenges, which are GHG Emission, Biodiversity & Water Use, two people KPIs for improving Social and Health crises, and one enabler KPI, Impact Intelligence, to support global climate goals.

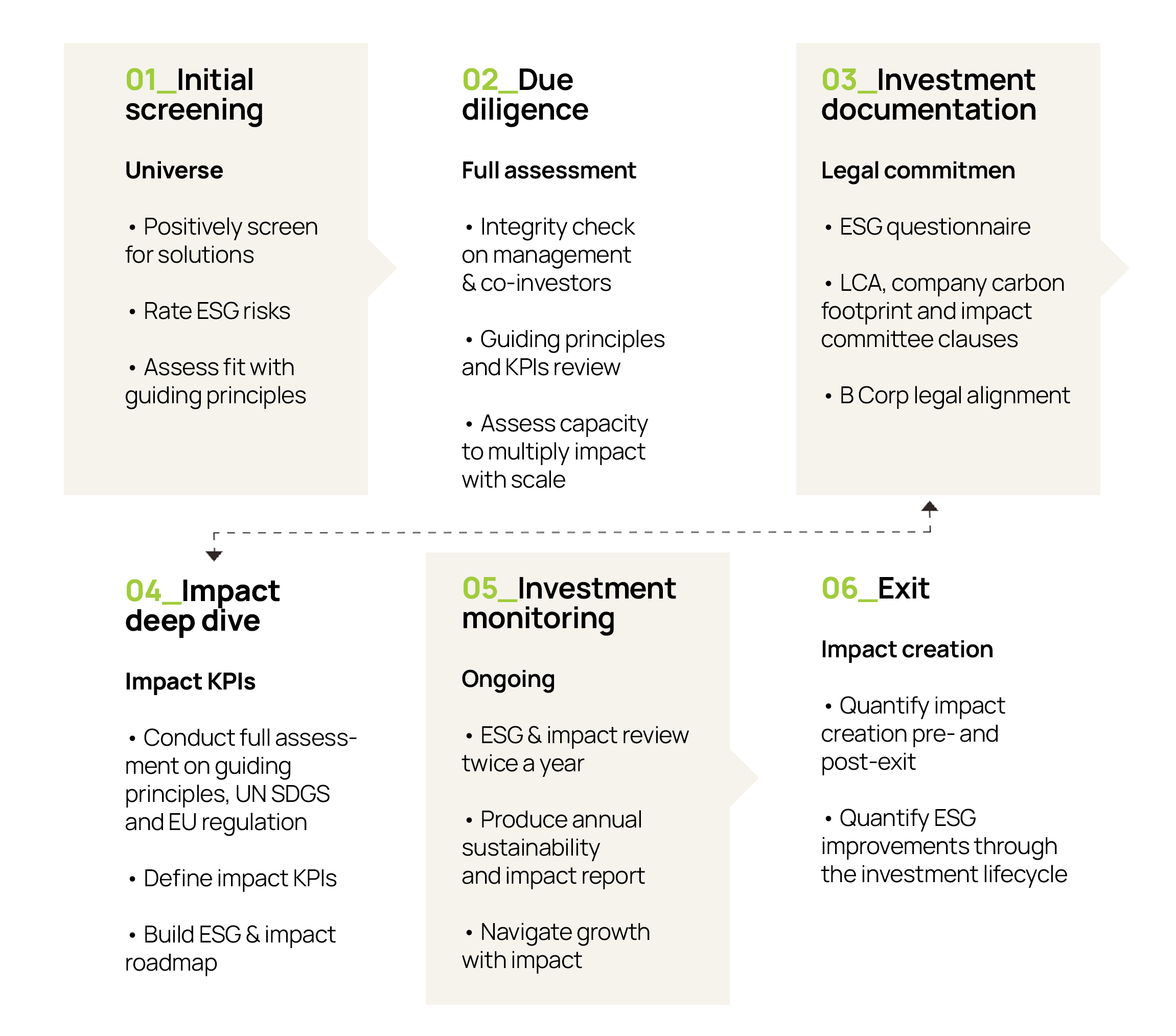

Investment Process

ESG and impact are systematically integrated in to each step of the investment process, led by our six guiding principles and six impact KPIs. Collaboration with portfolio companies and transparency are the key cornerstones of our impact creation process.

We continuously engage with our portfolio companies to improve their ESG profiles and scale their impact throughout each step of the relationship, from initial screening to exit. Transparency on our impact creation process is a fundamental element of our approach, as we strive to lead and inspire both entrepreneurs and investors in their impact creation journeys.

Impact Ecosystem

Astanor plays an active role in responsible investing organizations and working groups to help strengthen and facilitate the adoption of impact investing. Astanor is a signatory of the PRI and a member of Invest Europe and its Responsible Investment Roundtable.

Good Harvest Ventures I, Astanor’s first fund, is a signatory of the Impact Principles and an Article 9 investment fund.

Our B Corp journey

From Astanor’s inception, we have been driven by a vision where profitability and sustainability are interconnected. Astanor was ‘born’ with the vision that businesses must be a force for good, and this conviction has shaped our trajectory. This commitment is reflected in our achievement of a strong B Corp score of 121.3. This score is a source of pride and a recognition of our genuine commitment to fostering positive change through investments that prioritize both the people and the planet.

Our B Corp achievement does not mark the end of our journey; rather, it serves as a milestone that propels us forward. We believe that sustainability is an ongoing journey, and there is always room for improvement.

Impact

documentation

SOCIAL

We invest in solutions that support equity and socioeconomic stability for producers and consumers across the globe.