A global leader in impact investing

Our mission as an impact investor is to find, support and scale the most disruptive, impactful solutions to accelerate progress towards global sustainability targets.

Impact investing is the key catalyst that can finance and scale the systemic disruption needed to reach the ambitious targets set forth by the Paris Agreement, the UN SDGs and the European Commission’s Farm to Fork strategy.

By investing in promising, technology-driven, impact-focused companies we experience no trade-off between return and impact. The more successful the business, the more impact there will be.

Our Approach

Defining the right impact metrics is an essential first step to determining and measuring success. We have defined a set of six impact KPIs that enable us to capture a holistic image of our companies’ positive impacts on both people and the planet across the entire agrifood value chain.

Planet: Three planet KPIs to efficiently assess how to address the challenge of climate change: GHG Emissions, Water Use & Biodiversity

People: Two people KPIs to measure our contribution to improving social and health crises: Social & Health

Enablers: A third category of KPIs, necessary to assure our collective advancement towards global climate goals. Today, we have one enabler KPI: Impact Intelligence

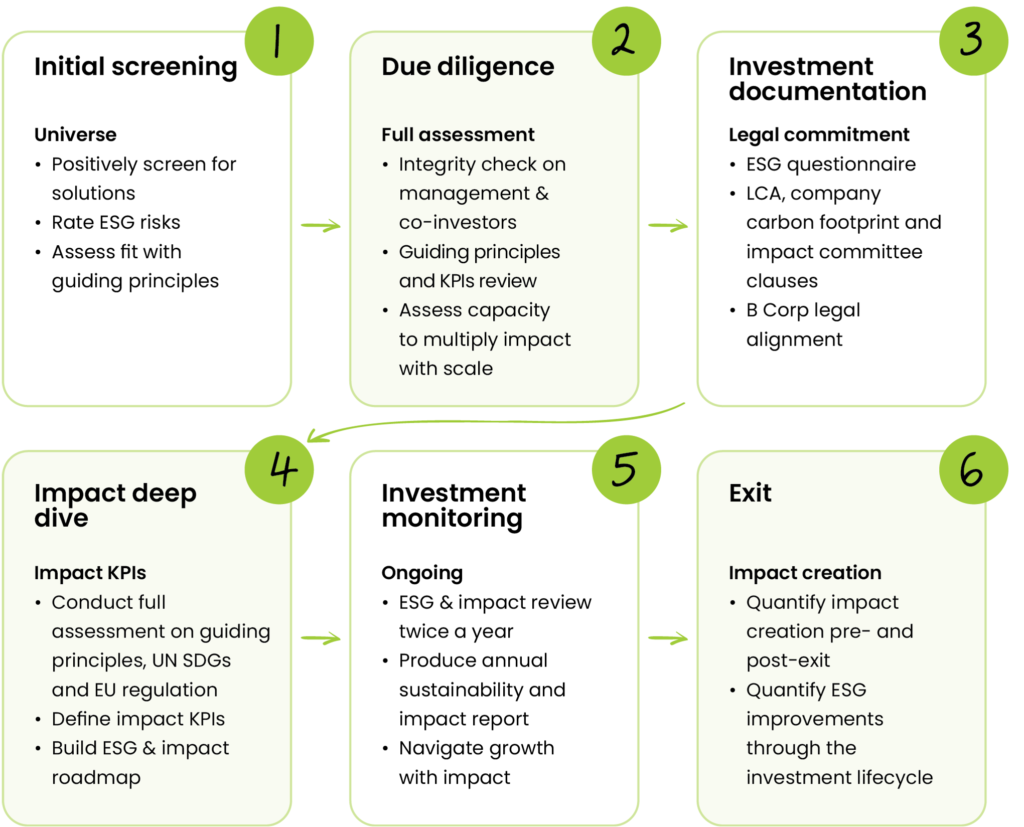

Investment Process

ESG and impact are systematically integrated in to each step of the investment process, led by our six guiding principles and six impact KPIs. Collaboration with portfolio companies and transparency are the key cornerstones of our impact creation process.

We continuously engage with our portfolio companies to improve their ESG profiles and scale their impact throughout each step of the relationship, from initial screening to exit. Transparency on our impact creation process is a fundamental element of our approach, as we strive to lead and inspire both entrepreneurs and investors in their impact creation journeys.

Impact Ecosystem

Astanor plays an active role in responsible investing organizations and working groups to help strengthen and facilitate the adoption of impact investing. Astanor is a signatory of the PRI and a member of Invest Europe and its Responsible Investment Roundtable.

Good Harvest Ventures I, Astanor’s first fund, is a signatory of the Impact Principles and a Art 9 (2) dark green investment fund under the EU Sustainable Finance Disclosure Regulation (SFDR).